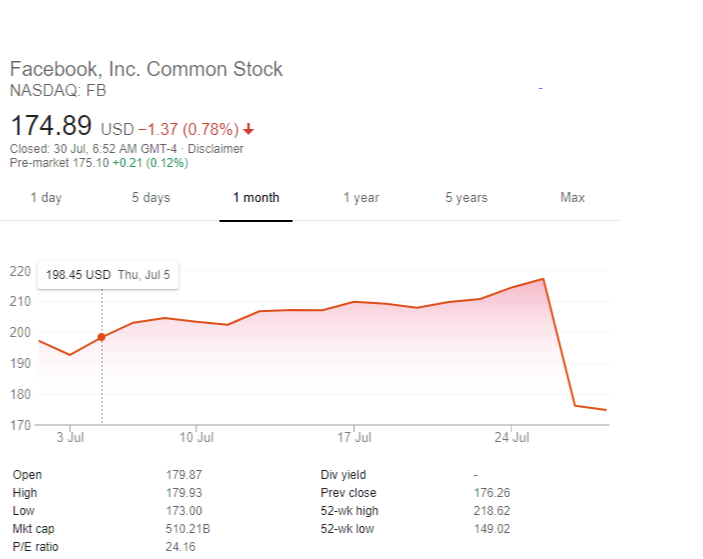

After been found guilty of providing discriminatory advertisements on its platform earlier this week, Facebook hit yet another wall yesterday as its stock closed falling down by 18.96% on Thursday with shares selling at $176.26. This means that the company lost around $120 billion in market value overnight, making it the largest loss of value ever in a day for a US-traded company since Intel Corp’s two-decade-old crash. Intel had lost a little over $18 billion in one day, 18 years back. Despite the 41.24% revenue growth compared to last year, this was Facebook’s biggest stock market drop ever. Here’s the stock chart from NASDAQ showing the figures:

Facebook’s market capitalization was worth $629.6 on Wednesday. As soon as Facebook’s Earnings calls concluded by the end of market trading on Thursday, it’s worth dropped to $510 billion after the close. Also, as Facebook’s market shares continued to drop down during Thursday’s market, it left its CEO, Mark Zuckerberg with less than $70 billion, wiping out nearly $17 billion of his personal stake, according to Bloomberg. Also, he was demoted from the third to the sixth position on Bloomberg’s Billionaires Index.

Active user growth starting to stagnate in mature markets

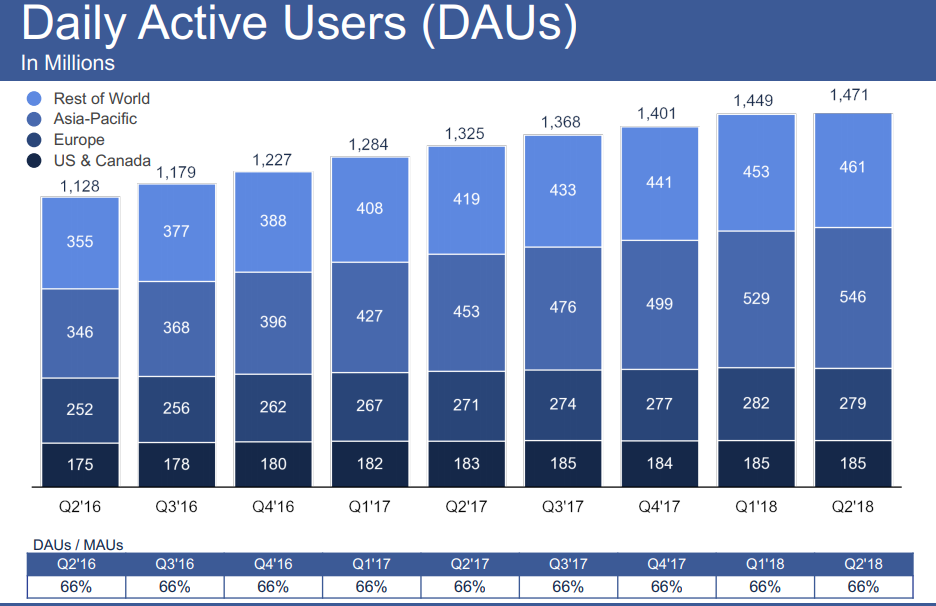

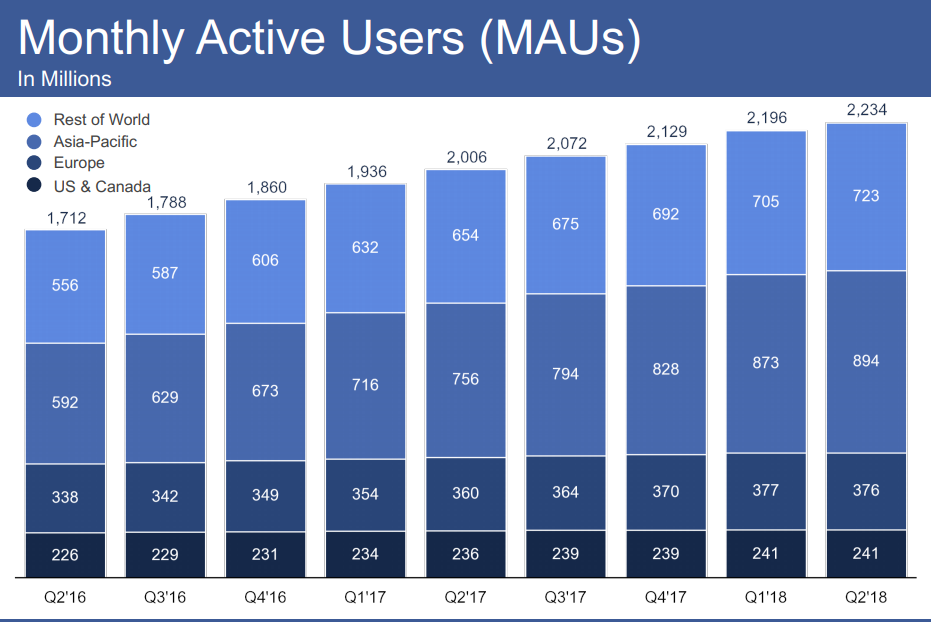

According to David Wehner, CFO at Facebook, “the Daily active users count on Facebook reached 1.47 billion, up 11% compared to last year, led by growth in India, Indonesia, and the Philippines. This number represents approximately 66% of the 2.23 billion monthly active users in Q2”.

He also mentioned that “MAUs (monthly active users) were up 228M or 11% compared to last year. It is worth noting that MAU and DAU in Europe were both down slightly quarter-over-quarter due to the GDPR rollout, consistent with the outlook we gave on the Q1 call”.

Facebook’s Monthly Active users

In fact, Facebook has implemented several privacy policy changes in the last few months. This is due to the European Union’s General Data Protection Regulation ( GDPR ) as the company’s earnings report revealed the effects of the GDPR rules.

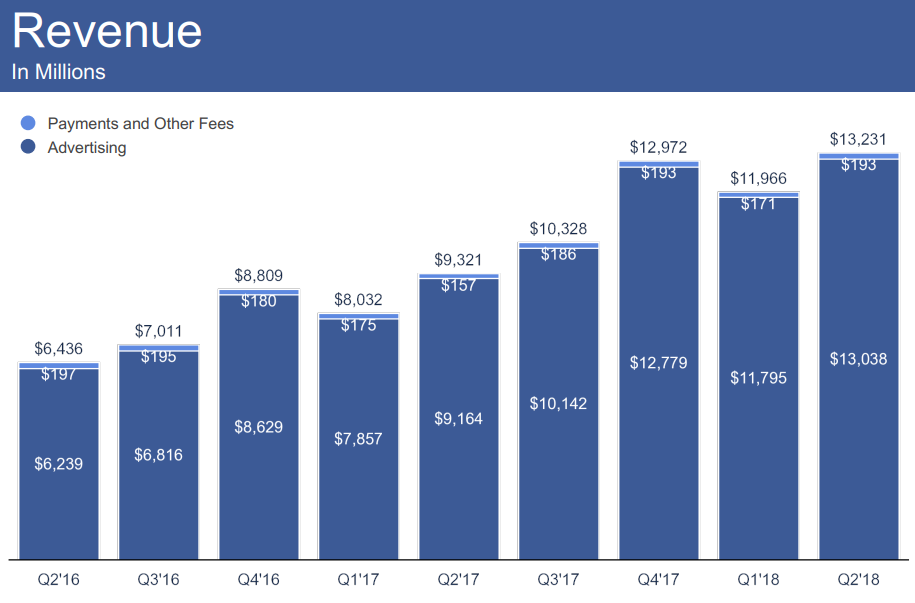

Revenue Growth Rate is falling too

Speaking of revenue expectations, Wehner gave investors a heads up that revenue growth rates will decline in the third and fourth quarters.

Wehner states that the company’s “total revenue growth rate decelerated approximately 7 percentage points in Q2 compared to Q1. Our total revenue growth rates will continue to decelerate in the second half of 2018, and we expect our revenue growth rates to decline by high single-digit percentages from prior quarters sequentially in both Q3 and Q4.” Facebook reiterated further that these numbers won’t get better anytime soon.

Wehner further spoke explained the reasons for the decline in revenue,“There are several factors contributing to that deceleration..we expect the currency to be a slight headwind in the second half …we plan to grow and promote certain engaging experiences like Stories that currently have lower levels of monetization. We are also giving people who use our services more choices around data privacy which may have an impact on our revenue growth”.

Let’s look at other performance indicators

Other financial highlights of Q2 2018 are as follows:

- Mobile advertising revenue represented 91% of advertising revenue for q2 2018, which is up from approx. 87% of the advertising revenue in Q2 2017.

- Capital expenditures for Q2 2018 were $3.46 billion which is up from $1.4 billion in Q2 2017.

- Headcount was 30,275 around June 30, which is an increase of 47% year-over-year.

- Cash, Cash equivalents, and marketable securities were $42.3 billion at the end of Q2 2018, an increase from $35.45 billion at the end of the Q2 2017.

Wehner also mentioned that the company “continue to expect that full-year 2018 total expenses will grow in the range of 50-60% compared to last year. In addition to increases in core product development and infrastructure — growth is driven by increasing investments — safety & security, AR/VR, marketing, and content acquisition”.

Another reason for the overall loss is that Facebook has been dealing with criticism for quite some time now over its content policies, its issues regarding user’s private data and its changing rules for advertisers. In fact, it is currently investigating data analytics firm Crimson Hexagon over misuse of data.

Mark Zuckerberg also said over a conference call with financial analysts that Facebook has been investing heavily in “safety, security, and privacy” and that how they’re “investing – in security that it will start to impact our profitability, we’re starting to see that this quarter – we run this company for the long term, not for the next quarter”.

Here’s what the public feels about the recent wipe-out:

Facebook loses 119 billion dollars of wealth in one day. Maybe turnin' a blind eye while Russia helped throw two elections wasn't Zuck's best idea?

— Tea Pain (@TeaPainUSA) July 26, 2018

Facebook's market cap loss in USD is equivalent to Bitcoin dropping 83% down to $1400 in a few hours

— Alistair Milne (@alistairmilne) July 26, 2018

So, why did Facebook’s stocks crash?

As we can see, Facebook’s performance itself in Q2 2018 has been better than its performance last year for the same quarter as far as revenue goes. Ironically, scandals and lawsuits have had little impact on Facebook’s growth. For example, Facebook recovered from the Cambridge Analytica scandal fully within two months as far share prices are concerned. The Mueller indictment report released earlier this month managed to arrest growth for merely a couple of days before the company bounced back. The discriminatory advertising verdict against Facebook, had no impact on its bullish growth earlier this week.

This brings us to conclude that the public sentiments and market reactions against Facebook have very different underlying reasons. The market’s strong reactions are mainly due to concerns over the active user growth slowdown, the lack of monetization opportunities on the more popular Instagram platform, and Facebook’s perceived lack of ability to evolve successfully to new political and regulatory policies such as the GDPR. Wall Street has been indifferent to Facebook’s long list of scandals, in some ways, enabling the company’s ‘move fast and break things’ approach.

In his earnings call on Thursday, Zuckerberg hinted that Facebook may not be keen on ‘growth at all costs’ by saying things like “we’re investing so much in security that it will significantly impact our profitability” and then Wehner adding, “Looking beyond 2018, we anticipate that total expense growth will exceed revenue growth in 2019.”

And that has got Wall street unfriending Facebook with just a click of the button!

Read Next

Is Facebook planning to spy on you through your mobile’s microphones?

Facebook to launch AR ads on its news feed to let you try on products virtually

Decoding the reasons behind Alphabet’s record high earnings in Q2 2018

![How to create sales analysis app in Qlik Sense using DAR method [Tutorial] Financial and Technical Data Analysis Graph Showing Search Findings](https://hub.packtpub.com/wp-content/uploads/2018/08/iStock-877278574-218x150.jpg)