Yesterday at Google’s annual shareholder meeting, Alphabet, Google’s parent company, faced 13 independent stockholder proposals ranging from sexual harassment and diversity, to the company’s policies regarding China and forced arbitration. There was also a proposal to limit Alphabet’s power by breaking up the company. However, as expected, every stockholder proposal was voted down after a few minutes of ceremonial voting, despite protesting workers. The company’s co-founders, Larry Page, and Sergey Brin were both no-shows and Google CEO Sundar Pichai didn’t answer any questions.

Google has seen a massive escalation in employee activism since 2018. The company faced backlash from its employees over a censored version of its search engine for China, forced arbitration policies, and its mishandling of sexual misconduct. Google Walkout for Real Change organizers Claire Stapleton, and Meredith Whittaker were also retaliated against by their supervisors for speaking out. According to widespread media reports the US Department of Justice is readying to investigate into Google. It has been reported that the probe would examine whether the tech giant broke antitrust law in the operation of its online and advertisement businesses.

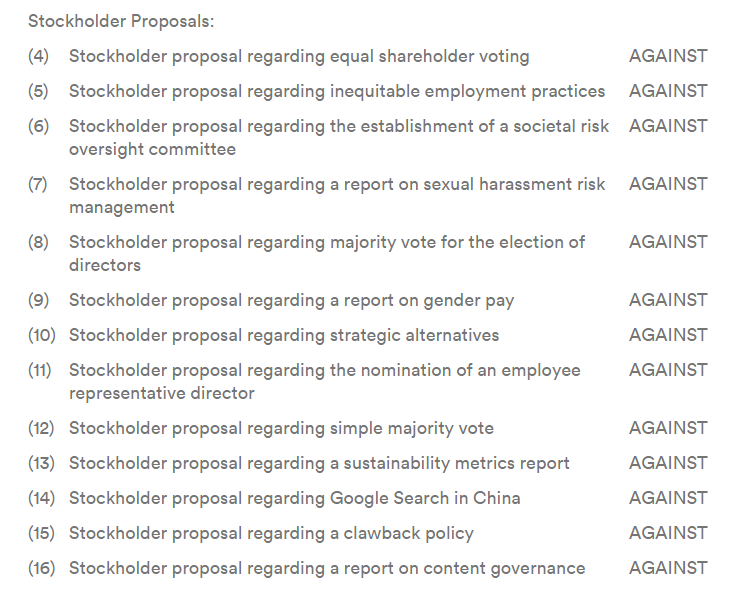

Source: Google’s annual meeting MOM

Equal Shareholder Voting

Shareholders requested that Alphabet’s Board initiate and adopt a recapitalization plan for all outstanding stock to have one vote per share. Currently, the company has a multi-class voting structure, where each share of Class A common stock has one vote and each share of Class B common stock has 10 votes. As a result, Page and Brin currently control over 51% of the company’s total voting power, while owning less than 13% of stock. This raises concerns that the interests of public shareholders may be subordinated to those of our co-founders.

However, board of directors rejected the proposal stating that their capital and governance structure has provided significant stability to the company, and is therefore in the best interests of the stockholders.

Commit to not use Inequitable Employment Practices

This proposal urged Alphabet to commit not to use any of the Inequitable Employment Practices, to encourage focus on human capital management and improve accountability. “Inequitable Employment Practices” are mandatory arbitration of employment-related claims, non-compete agreements with employees, agreements with other companies not to recruit one another’s employees, and involuntary non-disclosure agreements (“NDAs”) that employees are required to sign in connection with settlement of claims that any Alphabet employee engaged in unlawful discrimination or harassment.

Again Google rejected this proposal stating that the updated code of conduct already covers these requirements and do not believe that implementing this proposal would provide any incremental value or benefit to its stockholders or employees.

Establishment of a Societal Risk Oversight Committee

Stockholders asked Alphabet to establish a Societal Risk Oversight Committee (“the Committee”) of the Board of Directors, composed of independent directors with relevant experience. The Committee should provide an ongoing review of corporate policies and procedures, above and beyond legal and regulatory matters, to assess the potential societal consequences of the Company’s products and services, and should offer guidance on strategic decisions. As with the other Board committees, a formal charter for the Committee and a summary of its functions should be made publicly available.

This proposal was also rejected. Alphabet said, “The current structure of our Board of Directors and its committees (Audit, Leadership Development and Compensation, and Nominating and Corporate Governance) already covers these issues.”

Report on Sexual Harassment Risk Management

Shareholders requested management to review its policies related to sexual harassment to assess whether the company needs to adopt and implement additional policies and to report its findings, omitting proprietary information and prepared at a reasonable expense by December 31, 2019.

However, this was rejected as well based on the conclusion that Google has robust Conduct Policies already in place. There is also ongoing improvement and reporting in this area, and Google has a concrete plan of action to do more.

Majority Vote for the Election of Directors

This proposal demands that director nominees should be elected by the affirmative vote of the majority of votes cast at an annual meeting of shareholders, with a plurality vote standard retained for contested director elections, i.e., when the number of director nominees exceeds the number of board seats. This proposal also demands that a director who receives less than such a majority vote should be removed from the board immediately or as soon as a replacement director can be qualified on an expedited basis.

This proposal was rejected basis, “Our Board of Directors believes that current nominating and voting procedures for election to our Board of Directors, as opposed to a mandated majority voting standard, provide the board the flexibility to appropriately respond to stockholder interests without the risk of potential corporate governance complications arising from failed elections.”

Report on Gender Pay

Stockholders demand that Google should report on the company’s global median gender pay gap, including associated policy, reputational, competitive, and operational risks, and risks related to recruiting and retaining female talent. The report should be prepared at a reasonable cost, omitting proprietary information, litigation strategy, and legal compliance information.

Google says it already releases an annual report on its pay equity analyses, “ensuring they pay fairly and equitably.” They don’t think an additional report as detailed in the proposal above would enhance Alphabet’s existing commitment to fostering a fair and inclusive culture.

Strategic Alternatives

The proposal outlines the need for an orderly process to retain advisors to study strategic alternatives. They believe Alphabet may be too large and complex to be managed effectively and want a voluntary strategic reduction in the size of the company than from asset sales compelled by regulators. They also want a committee of independent directors to evaluate those alternatives in the exercise of their fiduciary responsibilities to maximize shareholder value.

This proposal was also rejected basis, “Our Board of Directors and management do not favor a given size of the company or focus on any strategy based on ideological grounds. Instead, we develop a strategy based on the company’s customers, partners, users and the communities we serve, and focus on strategies that maximize long-term sustainable stockholder value.”

Nomination of an Employee Representative Director

An Employee Representative Director should be nominated for election to the Board by shareholders at Alphabet’s 2020 annual meeting of shareholders. Stockholders say that employee representation on Alphabet’s Board would add knowledge and insight on issues critical to the success of the Company, beyond that currently present on the Board, and may result in more informed decision making.

Alphabet quoted their “Consideration of Director Nominees” section of the proxy statement, stating that the Nominating and Corporate Governance Committee of Alphabet’s Board of Directors look for several critical qualities in screening and evaluating potential director candidates to serve our stockholders. They only allow the best and most qualified candidates to be elected to the Board of Directors. Accordingly, this proposal was also rejected.

Simple Majority Vote

The shareholders call for the simple majority vote to be eliminated and replaced by a requirement for a majority of the votes cast for and against applicable proposals, or a simple majority in compliance with applicable laws. Currently, the voice of regular shareholders is diminished because certain insider shares have 10-times as many votes per share as regular shares. Plus shareholders have no right to act by written consent.

The rejection reason laid out by Google was that more stringent voting requirements in certain limited circumstances are appropriate and in the best interests of Google’s stockholders and the company.

Integrating Sustainability Metrics Report into Performance measures

Shareholders requested the Board Compensation Committee to prepare a report assessing the feasibility of integrating sustainability metrics into performance measures. These should apply to senior executives under the Company’s compensation plans or arrangements. They state that Alphabet remains predominantly white, male, and occupationally segregated. Among Alphabet’s top 290 managers in 2017, just over one-quarter were women and only 17 managers were underrepresented people of color.

Even after proof of Alphabet being not inclusive, the proposal was rejected. Alphabet said that the company already supports corporate sustainability, including environmental, social and diversity considerations.

Google Search in China

Google employees, as well as Human rights organizations, have called on Google to end work on Dragonfly. Google employees have quit to avoid working on products that enable censorship; 1,400 current employees have signed a letter protesting Dragonfly.

Employees said: “Currently we do not have the information required to make ethically-informed decisions about our work, our projects, and our employment.” Some employees have threatened to strike. Dragonfly may also be inconsistent with Google’s AI Principles.

The proposal urged Google to publish a Human Rights Impact Assessment by no later than October 30, 2019, examining the actual and potential impacts of censored Google search in China.

Google rejected this proposal stating that before Google launches any new search product, it would conduct proper human rights due diligence, confer with Global Network Initiative (GNI) partners and other key stakeholders. If Google ever considers re-engaging this work, it will do so transparently, engaging and consulting widely.

Clawback Policy

Alphabet currently does not disclose an incentive compensation clawback policy in its proxy statement. The proposal urges Alphabet’s Leadership Development and Compensation Committee to adopt a clawback policy. This committee will review the incentive compensation paid, granted or awarded to a senior executive in case there is misconduct resulting in a material violation of law or Alphabet’s policy that causes significant financial or reputational harm to Alphabet.

Alphabet rejected this proposal based on the following claims:

- The company has announced significant revisions to its workplace culture policies.

- Google has ended forced arbitration for employment claims.

- Any violation of our Code of Conduct or other policies may result in disciplinary action, including termination of employment and forfeiture of unvested equity awards.

Report on Content Governance

Stockholders are concerned that Alphabet’s Google is failing to effectively address content governance concerns, posing risks to shareholder value. They request Alphabet to issue a report to shareholders assessing the risks posed by content management controversies related to election interference, freedom of expression, and the spread of hate speech.

Google said that they have already done significant work in the areas of combatting violent or extremist content, misinformation, and election interference and have continued to keep the public informed about our efforts. Thus they do not believe that implementing this proposal would benefit our stockholders.

Read the full report here.

Protestors showed disappointment

As the annual meeting was conducted, thousands of activists protested across Google offices. A UK-based human rights organization called SumOfUs teamed up with Students for a Free Tibet to propose a breakup of Google. They organized a protest outside of 12 Google offices around the world to coincide with the shareholder meeting, including in San Francisco, Stockholm, and Mumbai.

Activists have arrived at @Google's AGM as we go inside to tell execs and shareholders the real life #humanrights impacts of their decisions. #DropDragonfly pic.twitter.com/PZRMvTtpUX

— SumOfUs (@SumOfUs) June 19, 2019

Alphabet Board Chairman, John Hennessy opened the meeting by reflecting on Google’s mission to provide information to the world. “Of course this comes with a deep and growing responsibility to ensure the technology we create benefits society as a whole,” he said. “We are committed to supporting our users, our employees and our shareholders by always acting responsibly, inclusively and fairly.”

In the Q&A session which followed the meeting, protestors demanded why Page wasn’t in attendance. “It’s a glaring omission,” one of the protestors said. “I think that’s disgraceful.” Hennessy responded, “Unfortunately, Larry wasn’t able to be here” but noted Page has been at every board meeting. The stockholders pushed back, saying the annual meeting is the only opportunity for investors to address him.

Toward the end of the meeting, protestors including Google employees, low-paid contract workers, and local community members were shouting outside. “We shouldn’t have to be here protesting. We should have been included.” One sign from the protest, listing the first names of the members of Alphabet’s board, read, “Sundar, Larry, Sergey, Ruth, Kent — You don’t speak for us!”

Get up! Get down! Contract workers run this town! #GoogleDoBetter pic.twitter.com/48OAI95jzS

— Google Walkout For Real Change (@GoogleWalkout) June 19, 2019

Outside the shareholder meeting now pic.twitter.com/ZNFmxNNLUQ

— Laura Weiss (@LauraEWeiss16) June 19, 2019

This meeting also marked the official departure of former Google CEO Eric Schmidt and former Google Cloud chief Diane Greene from Alphabet’s board. Earlier this year, they said they wouldn’t be seeking re-election.

Read Next

Google Walkout organizer, Claire Stapleton resigns after facing retaliation from management

Google employees lay down actionable demands after staging a sit-in to protest retaliation

![How to create sales analysis app in Qlik Sense using DAR method [Tutorial] Financial and Technical Data Analysis Graph Showing Search Findings](https://hub.packtpub.com/wp-content/uploads/2018/08/iStock-877278574-218x150.jpg)